POS-n-go Android POS Manual

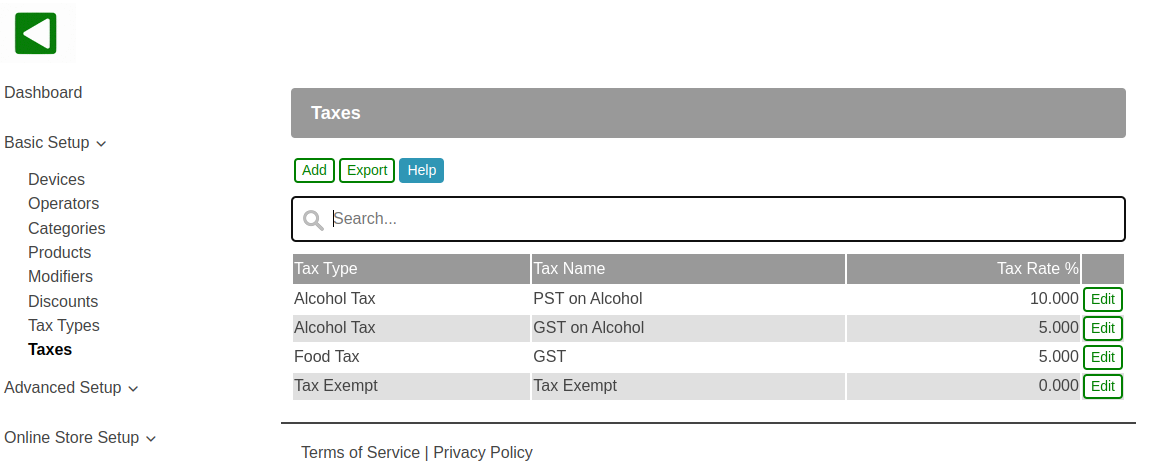

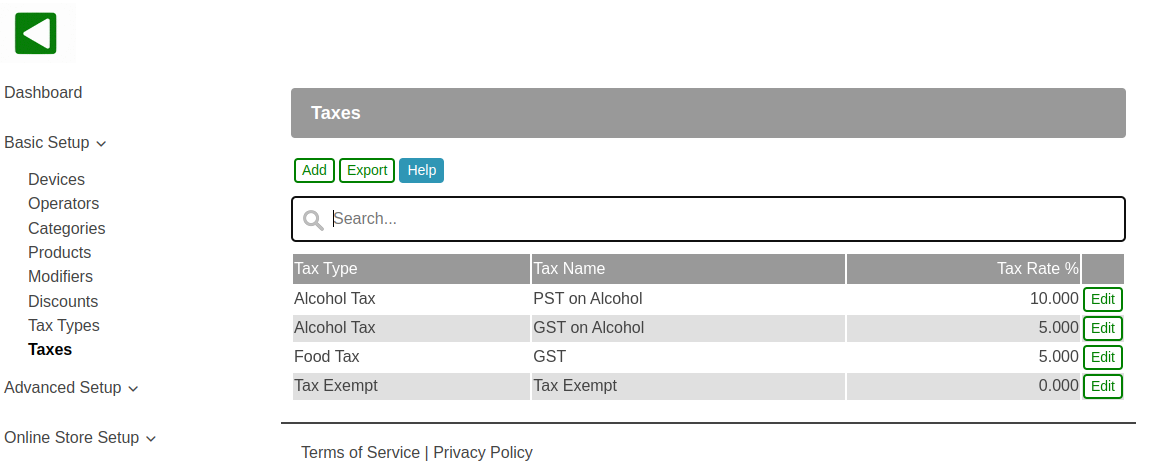

- Taxes are configured in the web portal, Basic Setup, Taxes.

- Tax rates are in percentages with up to 3 decimal points.

- Examples of tax rates are 5.000% GST or 9.975% QST.

- Tax names are included on customer receipts.

- To add a tax select the Add button.

- To make changes to an existing tax select the Edit button.

- The Export button allows you to export the list of taxes in CSV format for a spreadsheet.

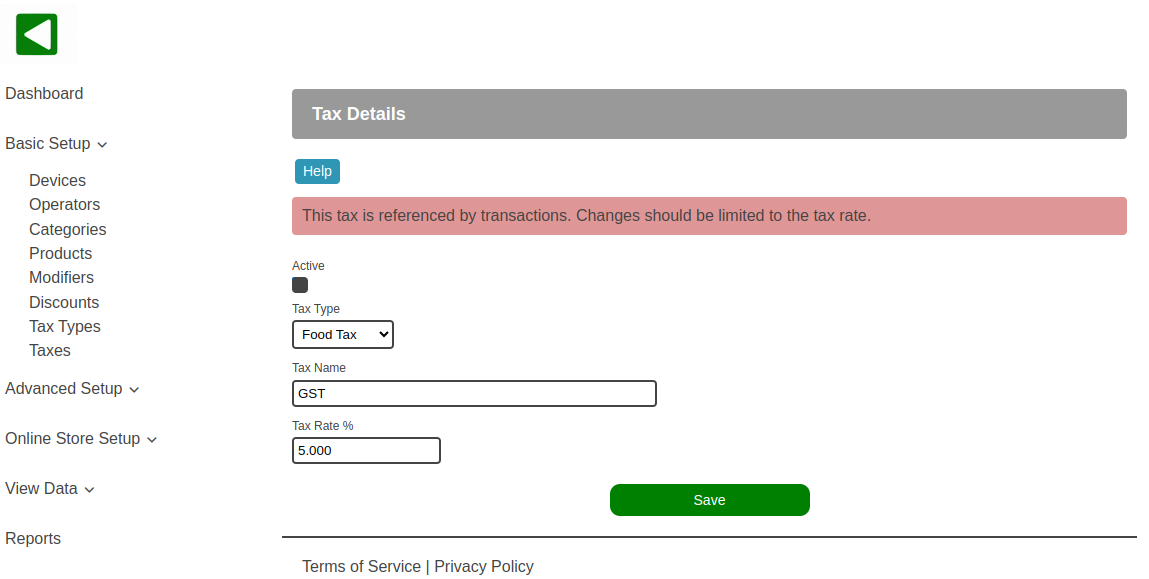

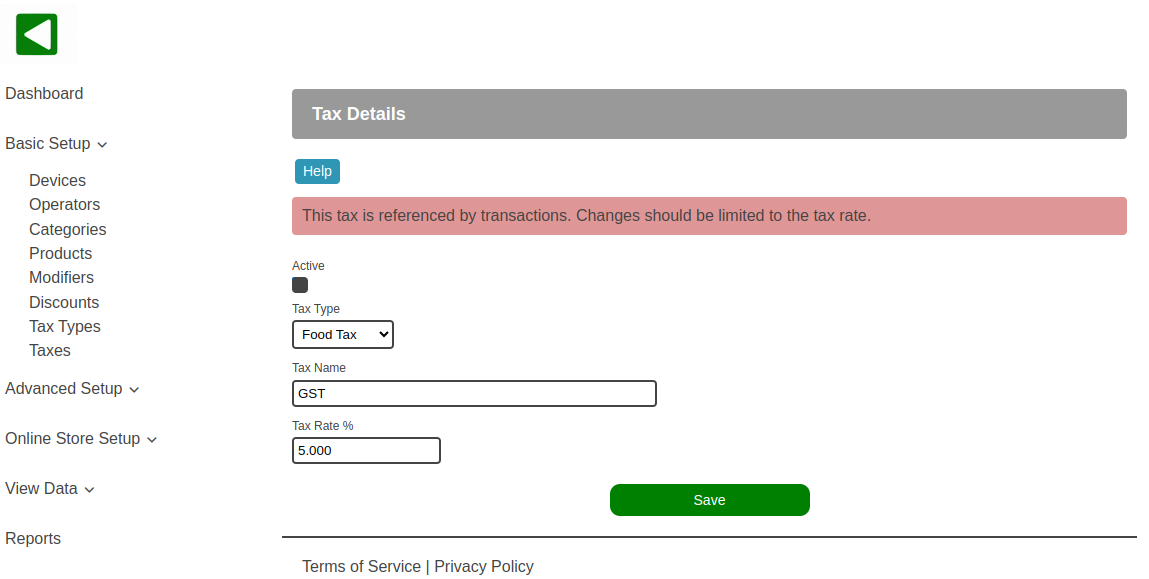

- You cannot delete a tax but you can deselect the Active checkbox to deactivate it.

- The mandatory fields for taxes are the Tax Type, Tax Name and Tax Rate.

- The Tax Type is the high-level tax category.

- The Tax Name is the name of the tax that will be included on customer receipts.

- Tax Rate is the tax rate percentage.