POS-n-go Android POS Manual

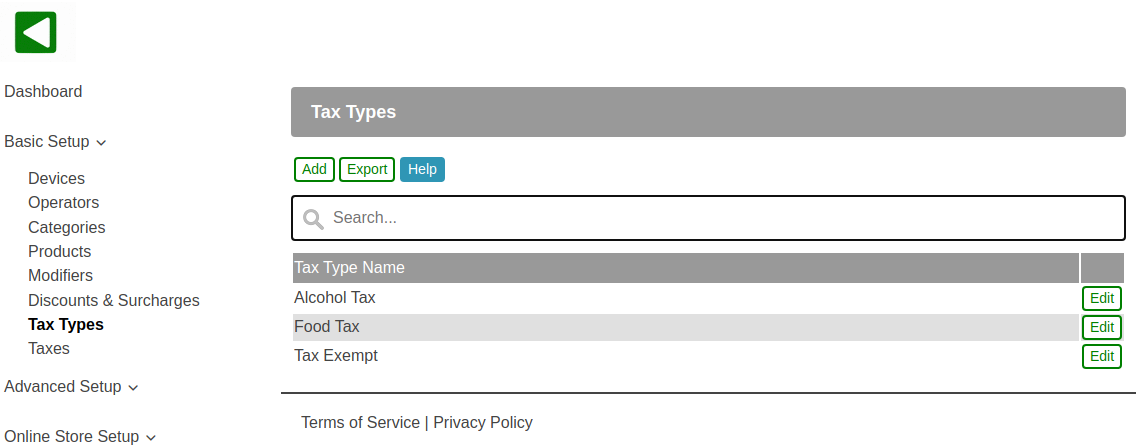

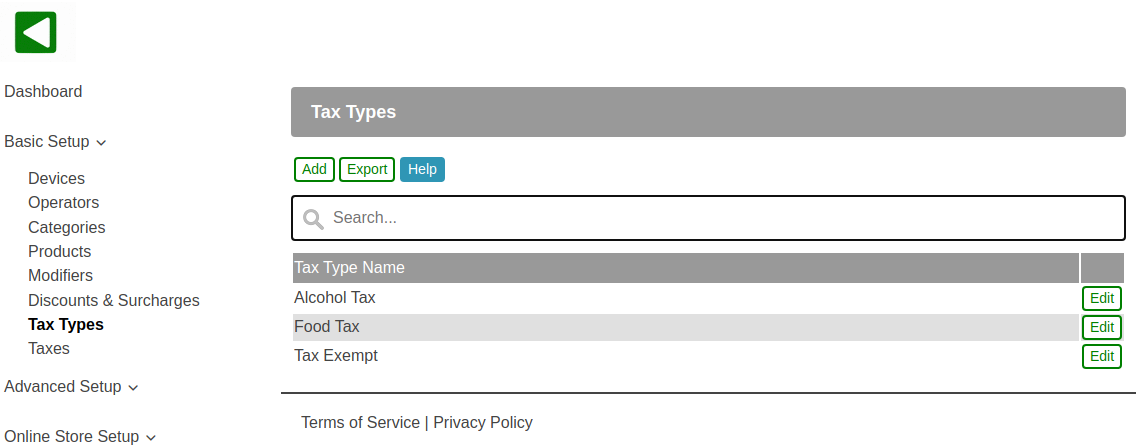

- Tax Types are configured in the web portal, Basic Setup, Tax Types.

- They are used to define a high-level tax category to group one or more taxes within.

- Examples of tax types are Tax Exempt, Sales Tax, Alcohol Tax, Food Tax or Product Tax.

- Individual products are assigned to a tax type. Tax type names are not included on customer receipts.

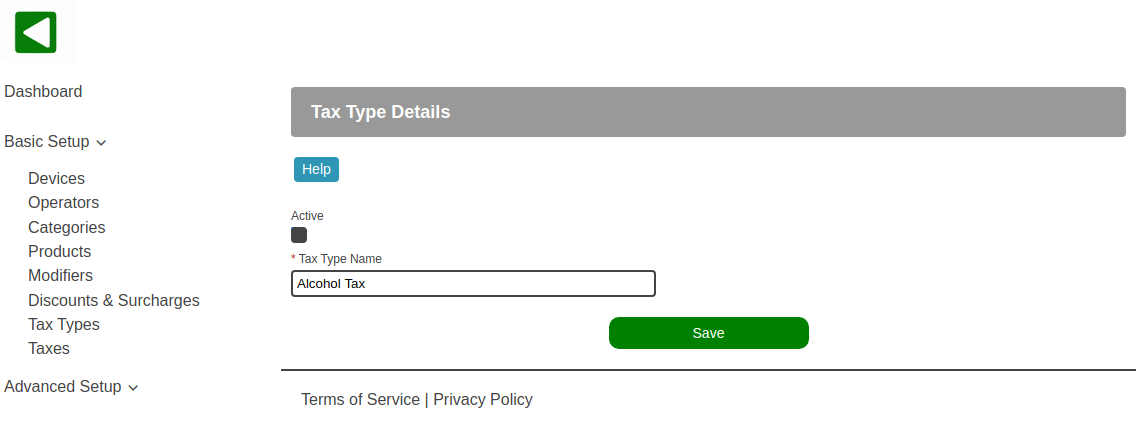

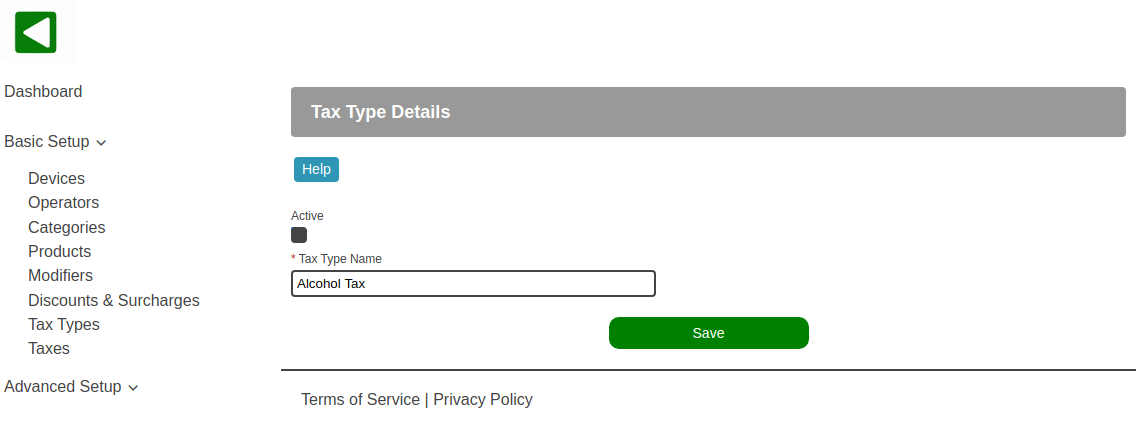

- To add a tax type select the Add button.

- To make changes to an existing tax type select the Edit button.

- The Export button allows you to export the list of tax types in CSV format for a spreadsheet.

- You cannot delete a tax type but you can deselect the Active checkbox to deactivate it.

- The only mandatory field for a tax type is the Tax Type Name.